Spanish Inheritance Law: Everything You Need to Know

Spain has some of the most complex Inheritance Laws in Europe. If you have assets, or will inherit assets in Spain, it is important to understand how Spanish Inheritance Law will affect your Estate. In this article, we explore the basics of Spanish Inheritance Law and how it might apply to you.

How does the Spanish Inheritance Law work?

When you acquire something as an Inheritance or a Gift, you are legally required to pay the tax known as Inheritance and Gift Tax (ISD). This tax is regulated by state regulations and is required throughout the Spanish territory.

According to Law 29/1987, individuals who acquire property without paying for it are subject to the Inheritance and Gift Tax. The administration of the Spanish Inheritance Tax is handled by the autonomous communities, with some jurisdictions regulating it more strictly than others. The majority of the Autonomous Communities enact reductions or incentives, and taxes may differ considerably from one to another.

When are you required to pay Inheritance and Gift Tax?

They are obliged to pay the Tax as taxpayers:

Successions in Spain

In Spain, when a person dies, their Estate is subject to Inheritance Tax. This tax is paid by the successors, who are usually the deceased person’s relatives. The amount of tax payable depends on the value of the Estate and the relationship between the deceased and the successors.

Donations in Spain

In Spain, Donations are subject to Inheritance Tax. This means that if you receive a donation from a family member or close friend, you will need to pay Inheritance Tax on the amount of the donation. The tax rate varies depending on the relationship between the donor and the recipient.

Life insurance

Spanish Inheritance Law stipulates that Life Insurance benefits are subject to taxation. This is because life insurance is considered to be part of the Estate of the deceased person. The beneficiaries of the life insurance policy will have to pay Inheritance Tax on the payout from the policy.

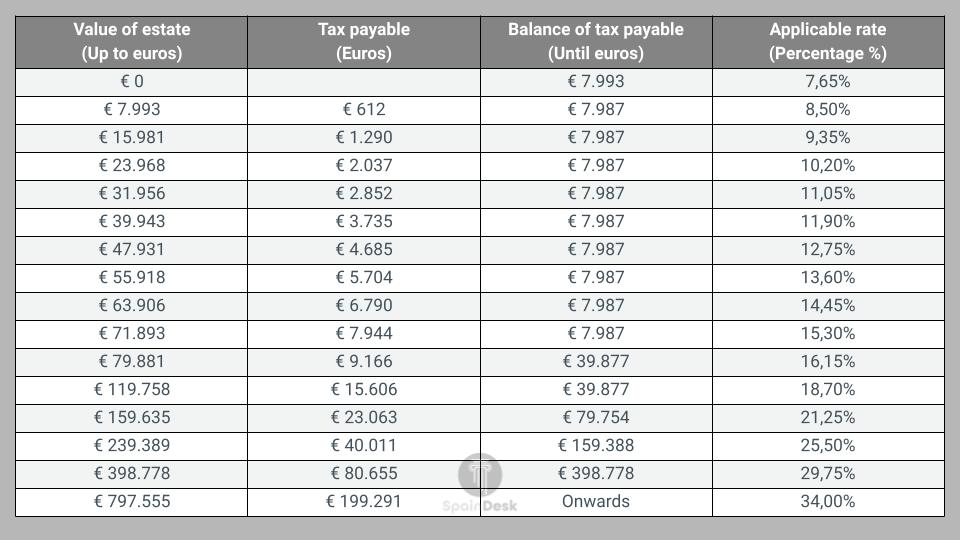

Spanish Inheritance Tax rate

Inheritance Taxes in Spain apply to assets transferred between spouses, siblings, and parents. The Spanish government has put in place a progressive tax. A progressive tax means paying more tax if you inherit a larger sum. Below is a detailed overview of the rate:

While the table above will give you an idea of the amount that needs to be paid, there are some exemptions. How much Inheritance Tax you have to pay can decrease through certain exemptions.

Important Spanish Inheritance Laws

Inheritance Tax Law in Spain can differ from Inheritance Tax laws abroad. The most important points are:

- In Spain, because there is no concept of a person’s “Estate,” all beneficiaries must pay Inheritance Tax in some shape or form.

- The Inheritance Law states that two-thirds of your belongings will automatically be given to your children.

- The Spanish Succession Tax is levied on all worldwide assets and an Inheritance and Gift Tax in one. If the assets are outside of Spain and the beneficiary is not a resident in Spain, no tax is applicable.

- There is a regional Inheritance Tax and state Inheritance Tax, and the Spanish Civil Code takes precedence if no regional rules apply.

- In Spain, there are forced heirship regulations limiting how you may distribute the inheritance.

- Spanish legislation requires that the Inheritance process be concluded within six months. As a result, it’s critical to contact an attorney as soon as possible.

Get help with your Inheritance in Spain from a professional

Spain’s forced inheritance rules

If your Estate is handled according to Spanish Inheritance Law, forced heirship rules apply (Law of Obligatory Heirs in Spain). As stated before, this means that you will be restricted in your Will when distributing your Estate.

The Law of Obligatory Heirs

The Law of Obligatory Heirs in Spain states that not only your children may receive your Spanish Inheritance. Also, your spouse and descendants of your children need to obtain a part.

Although this law varies from one territory to another, the Law of Obligatory Heirs in Spain generally ensures that 50% of the Estate goes to a spouse or registered partner, and the other 50% will move to the Estate. This 50% will then be divided into three portions equal.

- The first part will be equally between surviving children.

- The second part will go to the surviving children, but the deceased is free to distribute it in the manner they want. The surviving spouse keeps a life interest in this portion of the Estate, and the children do not inherit until after the surviving spouse passes away.

- The third part of the Estate will be freely distributed in the manner they want.

When there is a situation in which there are no children, then the surviving spouse can claim the other 50%. If there are no parents, children, or spouse, you may use a will to leave property to anybody.

You can’t give away more than one-third of your property (one-third) freely since you must set the rest aside for required heirs.

Reduce your Inheritance Tax in Spain through exemptions

Spanish Inheritance Law gives exemptions for paying Inheritance Tax, and these differ based on the heir’s relationship to the deceased. There is a division between the beneficiaries into four categories in Spanish Inheritance, and there is also a tax exemption for people with disabilities.

Group 1: Young children

In this group fall children under the age of 21. They will get a tax exemption for the first €47,859, which implies that no Inheritance Tax will be required to be paid over the first €47,859.

Group 2: Older children and direct family

In this group fall the children over the age of 21, grandchildren, spouses, and parents/grandparents (including adoptive). They don’t have to pay tax over the first €15,957.

Group 3: Close relatives

In this group fall the siblings, aunts, uncles, nieces, nephews, in-laws, and their ascendants/descendants. They will get an Inheritance Tax exemption of €7,993.

Group 4: Far relatives

In the fourth group fall the cousins, other relatives, unmarried partners (unless the region allows it) and those who are unrelated. These will get no Inheritance Tax exemption.

Group 5: Disabled People

Those with disabilities receive an allowance of either €47,859 or €50,253, depending on the extent of the disability.

Each Spanish region is free to change the tax allowance amounts for these categories at any time. As a result, contacting an Inheritance Lawyer who will help you figure out how much Spanish Inheritance Tax you owe is recommended.

Inheritance Tax and Residency

Any beneficiary of a bequest is subject to Spanish Inheritance Tax on assets acquired after death, as well as on lifetime gifts. Both residents and non-residents are subject to Inheritance Tax, and since 2015, the tax has been the same for residents and non-residents.

Inheritance from a Spanish non-resident

In Spain, non-residents must pay Inheritance Tax if they inherit assets. In other words, although not a tax resident of Spain, the heir must pay taxes if they inherit property from a deceased person who was a resident of Spain. Only the deceased’s Spanish assets are taxed, not his foreign assets.

Inheritance from a Spanish resident

If you happen to be a resident of Spain, you must pay for all of your Inheritance’s costs in the Spanish State if it comes from assets on Spanish soil or abroad. However, if the Inheritance was also paid outside of the country, you can deduct these taxes from your Spanish Inheritance Tax.

Creating a Will in Spain

A Will is a legal document stating how you want your assets to be distributed after death. It also provides instructions for the care of any minor children or dependents who are financially dependent on you.

When you are creating a Spanish Will, you need to be aware that Spanish Laws are different from those abroad. For the Will to be valid you need at least two witnesses, next to this it needs to be drafted in Spanish, and deposited at the Notary. You must also:

- Be at least 18 years old

- Make it on your own

- Be of mental capacity

- Make it in writing

- Sign it in the presence of all parties

Challenges that come with Inheritance

The difficulties of Inheritance include emotions, family dynamics, and the grief associated with losing a loved one, these challenges include

- Claims regarding the use of powers of attorney

- The validity of Wills and trust plans

- The transfer of common property

- Gifts made during a donor’s lifetime

- Legal demands and accountability to government authorities

Next to these, specific testamentary clauses can alter when they are illegal or harm the heirs. The heirs can contest a Will when the formalism cannot follow or if its stipulations injure them. Contact us, if you want to contest an inheritance or are being contested.

Frequently asked questions

Below you can read frequently asked questions on Spanish Inheritance Law.

What is an Estate Tax?

The Estate Tax is charged to your right to transfer property after you pass away. It’s the sum of everything you owned at the time of death. This sort of tax is calculated based on the deceased person’s net worth at the time of death.

What is an Inheritance Tax?

Inheritance Tax, also known as death tax or succession tax, is calculated based on who gets the deceased person’s assets. The Inheritance/Estate tax percentage is determined by the present value of the asset received by the heir/beneficiary and his actual connection with the decedent. Heirs are exempt from Inheritance Taxes in some cases, and sometimes rates are significantly reduced. However, distant relatives or friends of the deceased might be subjected to a higher Inheritance Tax rate.

What is a Gift Tax?

A Gift Tax is a type of tax that is levied on the transfer of valuable items. Because the name implies “gift,” the receiver cannot pay the giver the full value of the present, but they may pay something less than that. It is required under a Gift Tax for the individual who hands over the present to pay taxes.

Is Spanish Inheritance Tax deductible?

The Spanish Inheritance Tax deduction is a concept that reduces the tax liability of the family members who receive the transfer. If tax deduction apply, you will need to prove your relationship.

Who is responsible for Spanish Inheritance and Gift Tax?

The person receiving a gift or an Estate in Spain is liable to Spanish Inheritance Tax unless a specific Spanish Inheritance Tax deduction applies. Spanish Inheritance Tax exemptions may apply if the person receiving a gift or an Estate in Spain is a Spanish resident or national.

Where do I pay the lowest Inheritance Taxes in Spain?

The Basque Country, Andalusia, Cantabria, the Canary Islands, the Community of Madrid, and Extremadura are the Autonomous Communities that almost entirely exempt the closest relatives from paying taxes.

Are the Gift Tax and Inheritance Tax rates the same?

Yes, the Inheritance and Gift Taxes are of the same rate.

Get help with Inheritance Law in Spain

If you need help from a Spanish Inheritance Lawyer, we can help. We offer a variety of Inheritance services such as Will drafting, probate assistance, Inheritance tax planning, and more. If you have a question about Inheritance Law in Spain, please don’t hesitate to contact us.

Disclaimer: Information on this page may be incomplete or outdated. Under no circumstances should the information listed be considered professional legal advice. We highly recommend seeking guidance from a legal expert if you lack extensive knowledge or experience dealing with any of the procedures outlined in these articles.