Income Tax in Spain in 2025: The Essential Guide

Income Tax in Spain in 2025 outlines how individuals and households across Spain calculate and pay taxes on their yearly earnings. Whether you’re a resident worker, freelancer, or expat, understanding how the tax system works helps you plan better and avoid surprises. Income tax is one of the most common taxes in Spain. This article explains the main elements of the 2025 income tax system, including who needs to file, what rates apply, and how deductions work.

What is personal income tax?

Personal income tax in Spain or Impuesto de Renta sobre las Personas Físicas (IRPF) is a direct tax on an individuals personal income. It is not the same as corporate income tax. Spanish personal income taxes are divided between the state and the autonomous regions. Although the state has created simplified tax thresholds, the rates and tax bands will vary depending on the autonomous region you’re located in.

To get started, you’re required to apply for a tax identification number known as an NIE number. Citizens of the EU usually need to apply for this number after three months of residency in the country, while citizens from countries outside the EU will generally receive their application with their Spanish residency.

Who pays income tax in Spain?

Even if you’re not a legal resident of Spain, you could still be considered a tax resident. You must file your income tax returns in the country if you meet any of the following requirements:

- Have spent more than 183 calendar days per year within the country.

It’s important to note that short absences will be considered a part of this number unless you have proof of your tax residence in another country. - You have a spouse or dependents who are tax residents of Spain.

- If you have a business or economic interests located within the country. For example, if you are starting a business in Spain, you will pay income tax in Spain.

Additionally, if you have a Spanish address, licence plate, phone number, bank account, or have used the healthcare system you could also be considered a tax resident unless you can prove otherwise.

Spanish tax for residents

For those employed by Spanish resident companies, the employer is required to withhold an amount of your taxable income to essentially pre-pay your tax returns. The deductions from your paycheck are an estimate of what will be paid at the end of the tax year. Authorities will then deduct these amounts from your final tax bill and refund any excess amounts paid.

In addition, tax residents of Spain must declare any assets held outside of the country through the Modelo 720. This includes bank accounts in your name (or that you manage), insurance, real estate, and more.

Tax in Spain for non-residents

Non-residents of Spain are also taxed on income earned in the country. Typically this is a 24% flat rate on work income and 19% on capital gains and investment income earned in Spain. Next to this, it is important to note that tax returns for non-residents must be filed on an individual basis and not submitted jointly with a spouse.

Earnings subject to income tax in Spain

There are several different sources that Spanish tax residents are required to pay income taxes from. Two types of taxable income need to be taken into consideration when filing your taxes are the general taxable income (renta general) and savings income (renta del ahorro).

Taxes on general income

Spanish tax residents are liable to pay taxes on all worldwide income aside from savings income. This is inclusive of your salary, pension, rent, gambling winnings, etc.

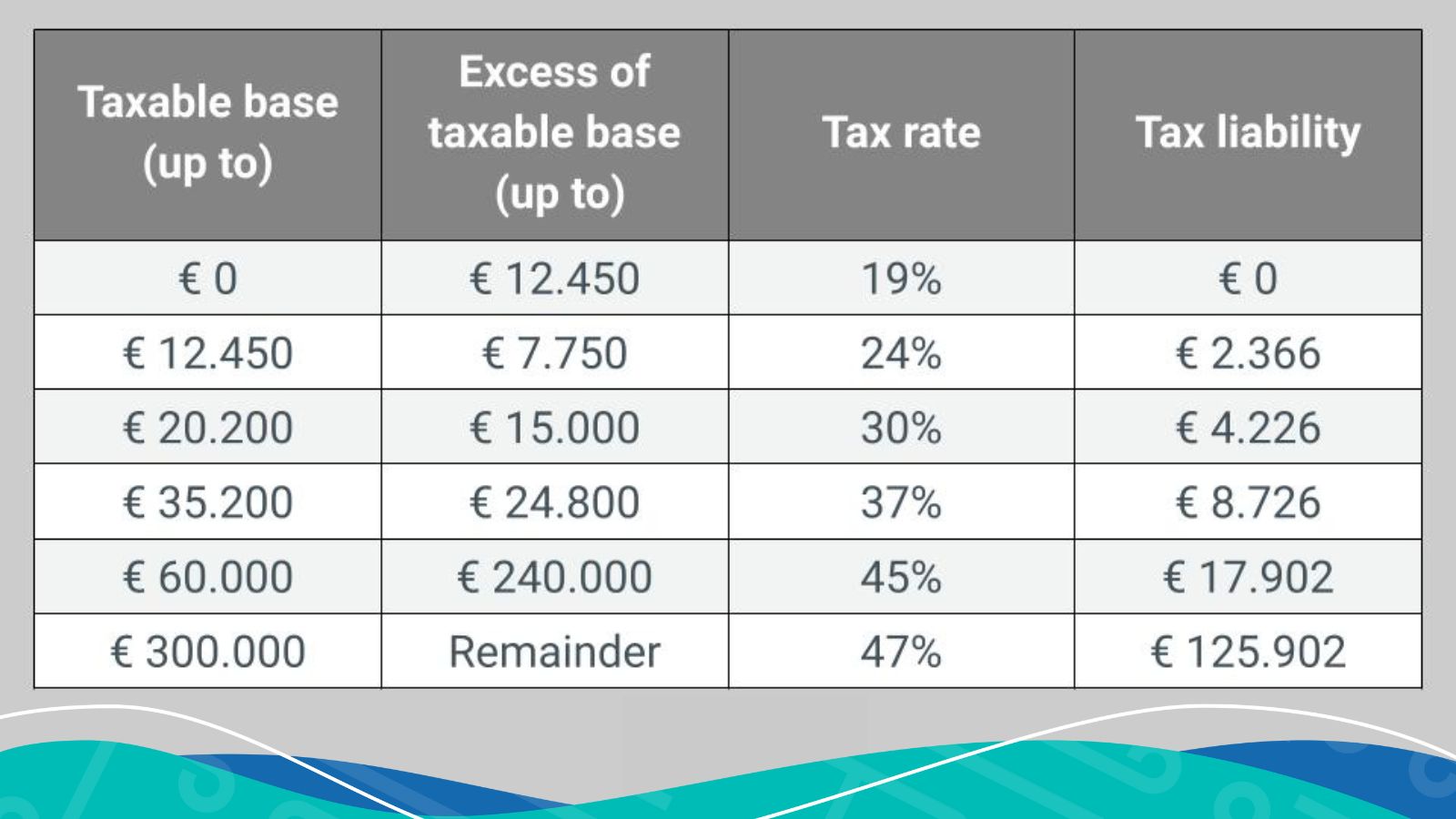

Two parts make up the Income Tax in Spain, a national and regional tax. Generally, the percentages are the same; however, they may vary slightly depending on the region you’re located in. The progressive income tax table is as follows:

Taxes on savings and investments

If you are a Spanish tax resident, you will also be taxed on your worldwide savings and investments. This includes the following:

- Interest gained on savings

- Dividends and income gained from holding interests in companies

- Any income from life and disability policies

- Income from annuities

- Capital gains made from the disposal or transfer of assets

The tax thresholds for savings and investment income are:

- Up to €6,000: 19%

- From €6,000 to €50,000: 21%

- From €50,000 to €200,000: 23%

- Over €200,000: 26%

Taxes on rental income

In addition to the previously mentioned income taxes, you are also liable to pay a tax on rental income in Spain. Any rental payments earned from a Spanish property are subject to a 19% rental income tax for both residents and non-residents from EU or EAA countries. If you are a non-resident not from the EU or EAA countries the flat tax rate is 24%. However, there are a number of deductibles on this tax, including expenses such as house insurance, local property tax, and repairs and management costs. This also includes a yearly 3% depreciation of the property.

Deductions and allowances

Spanish tax residents can enjoy a range of deductions and allowances on their personal income taxes. A standard allowance is granted for anyone under the age of 65 (€5,550), 65 and up (€6,700), and 75 and up (€8,100).

Additionally, if you have dependent children age 25 and under living with you, the following allowances are granted:

- €2,400 for the first child

- €2,700 for the second

- €4,000 for the third

- €4,500 for the fourth

- €2,800 as an additional allowance for each child under the age of three

Furthermore, you can typically claim tax deductions for the following:

- Payments made into the Spanish social security system

- Pension contributions in Spain

- Buying or renovating your home in the country

- Joint tax filings

- Charitable donations

Income Tax Deadlines

In Spain, the personal income tax year coincides with the calendar year. Therefore, the deadline to file your tax return for the previous year is the 30th of June.

Late Submission Penalties

Penalties for late income tax returns are judged on a case-by-case basis but generally include a fine for late submission and additional interest charges. However, you can usually expect something similar to the following interest rates for each timeframe past the due date:

- 3 months or less overdue: 5%

- 3-6 months overdue: 10%

- 6-12 months overdue: 15%

- A year or more overdue: 20%

An interest of 5% is typically charged on top of these amounts for payments that are more than one year overdue. In addition to these interest rates, the fine for late submission is €100 for nil returns. However, if the Tax Office prompts the return, the fine will increase to €200.

Next to this, it’s worth noting that in situations where the return is not made voluntarily, the following penalties will apply in addition to the previously mentioned fines and interest rates:

- Minor infraction: 50% of the tax due

- Serious infraction: 50–100% of the tax due

- Severe infraction: 100–150% of the tax due

How to file your Spanish tax returns

Everyone must file a Spanish income tax return in the first year of their tax residency in the country. The forms can be submitted online and require your digital identification certificate.

From the second year of tax residency onwards, it’s only necessary for you to file your tax return if you are earning over €22,000 as your employer will have already deducted the taxable amount. It’s important to note that this only applies if you have only one source of income.

Main changes since 2021

Since 2021, Spain’s income tax rules have gone through a series of updates aimed at adjusting to economic trends, policy goals, and sustainability efforts. In 2025, one of the most notable changes is the increase in tax on savings income over €300,000, which now stands at 30%. This applies both to regular residents and those under the special tax regime known as the “Beckham Law” for inbound expats.

There were also plans to raise the minimum income threshold that triggers the requirement to file a tax return, from €15,000 to €15,876. However, this adjustment was repealed, keeping the threshold unchanged. Another significant shift is the extended availability of deductions for investments in home energy efficiency, electric vehicles, and charging station installations. These deductions now apply through the end of 2025.

At the regional level, some autonomous communities are also reshaping their tax policies. For example, the Community of Madrid introduced tax breaks to attract foreign investors, partly in response to national tax measures. These regional variations are important to keep in mind when calculating your personal tax obligations.

A word from SublimeSpain

Navigating Income Tax in Spain in 2025 doesn’t have to be complicated. Once you understand the key rules, recent changes, and regional nuances, you’re in a much better position to make informed financial choices.

However, if you need professional advice for your personal income tax returns in Spain contact us. Our team of qualified tax and legal experts can offer specialized guidance and assistance to ensure your tax returns are filed correctly and on time.

Disclaimer: Information on this page may be incomplete or outdated. Under no circumstances should the information listed be considered as professional legal advice. We highly recommend seeking guidance from a legal expert if you lack extensive knowledge or experience dealing with any of the procedures outlined in these articles.